FinTech: Regulators take a note

The Reserve Bank of India (RBI) has released the final ‘Enabling Framework for Regulatory Sandbox’ with an intent to allow FinTech companies to test their applications before reaching out to final consumers. A 'Regulatory Sandbox' will allow FinTechs to live test their new products or services in a controlled or test regulatory environment. The regulator may permit even certain regulatory relaxations (on a case to case basis) for the limited purpose of the testing. The 'Regulatory Sandbox' will allow the stakeholders (regulator, FinTechs, customers) to conduct live field tests and assess the benefits and risks of new financial innovations, while containing their risks in a controlled environment. RBI in its report said "The objective of the Regulatory Sandbox is to foster responsible innovation in financial services, promote efficiency and bring benefit to consumers.."

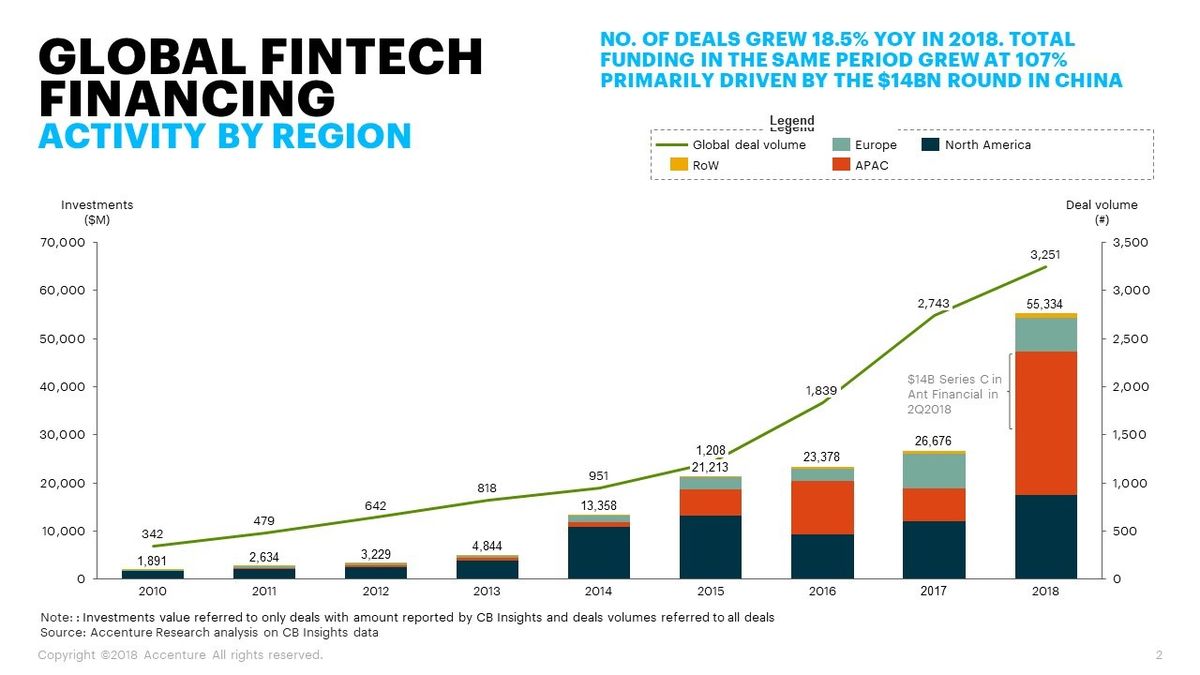

The move is quite timely and is in line with other central banks in the world that have set up regulatory sandbox to encourage the development of new technological applications in banking. It seems that RBI has also learnt from its micro finance experience in past where micro finance crept into the discourse of RBI without a clear policy. Hence, the framework for FinTechs clearly talks about 'Consumer Protection' in clause 6.8. The move is also timely as the ecosystem is fast-evolving in Asia-Pacific region and big investments are being made to sustain the momentum. China and India are experiencing much greater penetration rates for FinTech services. The Americas, Europe and Asia all saw significant growth in fintech investment. The first half of 2019 witnessed a total global investment of $37.9 billion across 962 deals. While the numbers may not seem huge compared to last year, the fintech market across the globe remained strong and well poised for growth.

FinTech is the next wave

As per the KPMG report Fintech investment increased substantially in 2018, with total global investment more than doubling from $50.8 billion in 2017 to $111.8 billion in 2018. Mega deals throughout the year helped to spur interest and activity in the FinTech market. Even in India, as per DataLabs report, $6.97 billion was raised across 453 deals by Indian FinTech startups (2014-2018). Currently, there are a app. 2,707 Fintech Startups in India. In 2019 itself, an estimated $2.36 billion was pumped into Indian FinTech startups. According to DataLabs estimates, Karnataka (87), Maharashtra (87) and Delhi NCR (66) have the highest concentration of funded FinTech startups in India. The concentration of FinTech startups seems to be skewed towards the Indian metros. One of the possible reasons lies in requirement of large amount of capital and a highly skilled workforce which are easily available in tier 1 cities such as Bengaluru, Mumbai and Delhi NCR, compared to tier 2 locations.

FinTech: Addressing The Unbanked Indian?

Fintech's ability to merge cutting edge digital technology with state of the art data sciences has made it the darling of investment community. While FinTech as a sector is agnostic to consumer segments, it cannot be missed that the biggest potential for it lies in reaching out to unbanked. Globally, ~70% of adults (3.8 bn.) now have an account at a bank or mobile money provider as per World Bank. Interestingly, about 1.2 bn. of these accounts have been added since 2011. Also, a significant increase has been witnessed in the use of mobile phones and the internet to conduct financial transactions. Between 2014-17, this has contributed to a rise in the share of account owners sending or receiving payments digitally from 67% to 76% globally, and in the developing world from 57% to 70%.

In India alone around 19 crore adults are without a bank account despite the success of the ambitious Jan Dhan Yojana, making it the world’s second largest unbanked population after that of China, as per the World Bank report. Besides, almost half of the bank accounts remained inactive in the past year. The report also said that 11% of the world’s unbanked adults are in India. Given this huge opportunity and ability of FinTech to redesign the mechanism of new financial services delivery as well as redefine the experiences to end customers the scope is huge. And such solutions have been succeeding in both emerging and developing economies, creating solutions specifically for underserved, low-income, or remote customers.

To understand how specific FinTech innovations solve pain points in financial inclusion, in 2016, CGAP supported pilots with 18 Fintech in Africa and South Asia that targeted financial services to low-income or undeserved customers. Through their case studies they identified five types of FinTech innovation that offer potential for financial inclusion. The results of their findings are as follows:

1. Interactive customer engagement:

Historically, financial literacy programs for the undeserved have delivered mixed results, yet technology has the potential to deliver customized information and knowledge that is cheaper, scalable, and effective. However, technology itself is not enough; efforts need to focus on understanding the undeserved community’s need for information. It is also crucial to have robust mechanisms to measure the effects on engagement with financial services. Contracts between the learning platform vendor and the Financial Service Provider (FSP) need to include an adequate degree of data sharing, which improves the platform’s ability to produce useful insights. There needs to be a balance between technology and “human” (high-touch) interaction in a cost-effective way. At the same time being customer-centric and maintaining a long-term vision is crucial to success.

A. FinTech's ability to generate robust analytics on engagement through its platform leading to increase in use of the financial services was integral to understand its value proposition to the customer and to the FSP.

B. Different communications strategies with each FSP may be required as lessons are context-specific, and not one-size-fits-all. Spending the time to test and learn what works for each audience and tailoring the relationship can make a significant difference.

C. Sharing social proof (hypothetical stories based on real use cases); Gradually increasing messaging; Providing customer centered information (secret tips) as a part of the conversation, as opposed to general instructive information and Initiating question-and-answer conversations increase the engagement levels

D. Offering choices (languages, topics of conversation etc.); Shaping the conversation and Feeling heard increased the customer engagement levels and also led to specific, actionable product feedback.

E. Allow new users to explore and test the service before they register for full use. Images, text and specially video can be very useful to explain how the service can be useful. Even on the investor side, from established players to early-stage companies, all are using blog posts, social media messages and innovative educational videos to explain the opportunity and help them make informed decisions.

2. Smartphone-based payments:

The spread of smart phones and mobile-phone use has spurred the need to create innovative applications that leverage intuitive user interfaces and user experiences (UI/UX) to reduce dormancy in payments and encourage greater use. These applications are for the mass market, undeserved customer. They are often designed to use less data and storage and to appeal to younger, tech-savvy, yet largely undeserved, populations in emerging markets.

A. Availability of a large acceptance network that can respond to requests for cash. This is not easy to build from scratch, and sometimes it may require to rely on an existing agent network to facilitate early transactions. Regulation issues and necessary license to provide services is another area to look at.

B. Providing in-app guidance and access to agents’ addresses and phone numbers so that users can find the most convenient or most reliable agent. Having an easy and simple initial application sign-up is crucial to speed customer acquisition. Allow users to navigate directly to what they want and focus on taking actions or doing (not plain navigation) within menus. Prefer quick visual cues over text but test it first on local users to avoid confusion. Using designs that are familiar to users and plain language which is already in use is another element to focus on.

C. Use consumer usage data to derive popular actions and customize the interface and choices as per their unique usage. Features such as auto fill or easily repeat past transactions are useful. Provide a simple feedback mechanism and clear pathways to resolve problems. Customized, simple keyboards; a fee calculator alongside transactions; a consolidated summary transaction information on one screen; making finding the account balance easy; easiness to hide the balance on the screen are helpful

D. The ability to send money by selecting a contact from the phone book, a ready list of various utility accounts (electricity, etc.) on the app’s interface; the ability to have several wallets for several SIMs; the ability to use the app offline was particularly relevant for users in remote areas that have poor connectivity and for users who bought data from one provider using a wallet from another.

3. Connections-based finance:

Digital technologies are being used to help customers connect to social, entrepreneurial, and community networks to gain access to small amounts of credit when cash-flow gaps arise in business and life. These services build customers’ creditworthiness and access to finance through existing or new connections. The small amounts keep the risk low and the timeliness of credit helps customers better plan for cash-flow gaps and emergencies.

A. Until a FinTech builds a larger group of customers, its success hinges on its partnerships with other FSPs, especially its credit partners, and their partners’ willingness to lend to their customers. A FinTech cannot control the user interface of its mobile partner and faces high API integration charges, which it cannot incur at this point. However, in absence of a better alternative, customers might be willing to overcome inadequacies of the mobile payment interface to access timely cash-flow relief.

B. The lower-income segment typically requires an element of human interaction. The last mile bridge not only helps people understand the product, it also overcomes trust barriers. The factor to watch out here is the need to balance the operation costs for these measures with a scalable business model. If a large base of customers successfully repays and comes back for more loans, these costs could be reduced.

C. Technology can be used to strengthen traditional financial relationships by reducing friction and providing visibility. It can also be used to help people expand and maintain their networks (rural-urban). The platform should be made more effective by right messaging strategy. For example, A heading that reads “Give today, receive tomorrow” could inspire reciprocity-driven contributions. A message like “Giving now increases your chance of succeeding with a future fundraising campaign” could be used to encourage trust-driven giving. Also, fostering a sense of community on a fundraising platform is likely to increase use.

D. There was no evidence that peer-to-peer framing increases loan repayment. There was some evidence that this framing could increase retention, thus increasing the chances of the borrower taking a second loan with the same lender. Customers who received an SMS message and a call (with right messaging) were more likely to take a second loan.

E. Success of services which are based on two-sided or multi-sided networks, hinges on growing each side robustly and ensuring adequate connections. Building strong credit scores for each supplier, improving information on each supply chain, and then expanding the lender group that agrees to assess risk based on the credit score and lend. Testing across different pricing models for each supply chain and each lender group may be useful. FinTech will need to keep its focus and expand strategically.

4. Location-based smallholder finance:

Use of digital technologies and alternative data sources to reduce cost and expand access to financial services, such as credit and insurance, and to other valuable extension services for (say smallholder farmers) customers.

A. Merging different location data; Building a image based scoring model to an overall credit-scoring model that contains other factors and variables; using a relevant loan performance sample to achieve a high degree of predictability - supported by an initial model using location-based data needs to be iterated and tested through several cycles of loans and repayment for success

B. A cost-effective way to gather information is critical to scaling and expanding access. Remote assessment models can be cost effective solution to gather data (farmer location) and are both effective and scalable. Input distribution and fulfillment via local dealers can be another cost effective and logistically simple to manage than direct delivery. Effectiveness of communication is crucial when introducing more complex financial products (bundled products)

C. Innovative satellite data applications has huge potential to improve efficiency and effectiveness within smallholder insurance markets. Also, it is critical for insurers to partner with public (especially) and private actors to facilitate access to accurate yield data, past and present, which are needed to complement satellite data. Larger yield data sets that cover larger geographical areas and longer periods of time may eliminate the need for yield sampling.

5. De-risking unproductive expenses:

Helping low-income people pay for unexpected or big expenses through de-risked credit, while using unique features to reduce risk for the financier.

A. The most significant remains the time required for the FSP to conduct a loan assessment and the cumbersome data-sharing process between FinTech and the FSP. The agreement between the two must include complete system integration through an API; mandatory training of FSP staff, including those in branches, before launch; complete visibility into incentives for branch staff and loan officers and clearly defined project governance structures. With a group like farmers making the technology work remains a major challenge. Also, lack of connectivity adds to the complexity.

B. Customers indicated that the feature they valued most was duration of insurance coverage. The other factors—amount of coverage and number of family members covered—were also important. And a combination of all three increased people’s willingness to pay. This suggests that the preferred solution should cover family members and offer a reasonable coverage amount, but that extending the duration of coverage should be emphasized.

It goes without saying that the combination of rapid strides in financial services technology and an honest commitment to financial inclusion by policy making institutions will go a long way in addressing the problem. We are at the cusp of a unique opportunity to resolve some of the most intractable challenges for financial inclusion and reach ‘last mile’ consumers with high quality financial services. I remain quite optimistic about the space for it sees financial inclusion as an opportunity and not as a challenge to address.

tag on profile.

tag on profile.

By Ashish H.K. Jha {{descmodel.currdesc.readstats }}

Ashish H.K. Jha {{descmodel.currdesc.readstats }}

FinTech: Regulators take a note

The Reserve Bank of India (RBI) has released the final ‘Enabling Framework for Regulatory Sandbox’ with an intent to allow FinTech companies to test their applications before reaching out to final consumers. A 'Regulatory Sandbox' will allow FinTechs to live test their new products or services in a controlled or test regulatory environment. The regulator may permit even certain regulatory relaxations (on a case to case basis) for the limited purpose of the testing. The 'Regulatory Sandbox' will allow the stakeholders (regulator, FinTechs, customers) to conduct live field tests and assess the benefits and risks of new financial innovations, while containing their risks in a controlled environment. RBI in its report said "The objective of the Regulatory Sandbox is to foster responsible innovation in financial services, promote efficiency and bring benefit to consumers.."

The move is quite timely and is in line with other central banks in the world that have set up regulatory sandbox to encourage the development of new technological applications in banking. It seems that RBI has also learnt from its micro finance experience in past where micro finance crept into the discourse of RBI without a clear policy. Hence, the framework for FinTechs clearly talks about 'Consumer Protection' in clause 6.8. The move is also timely as the ecosystem is fast-evolving in Asia-Pacific region and big investments are being made to sustain the momentum. China and India are experiencing much greater penetration rates for FinTech services. The Americas, Europe and Asia all saw significant growth in fintech investment. The first half of 2019 witnessed a total global investment of $37.9 billion across 962 deals. While the numbers may not seem huge compared to last year, the fintech market across the globe remained strong and well poised for growth.

FinTech is the next wave

As per the KPMG report Fintech investment increased substantially in 2018, with total global investment more than doubling from $50.8 billion in 2017 to $111.8 billion in 2018. Mega deals throughout the year helped to spur interest and activity in the FinTech market. Even in India, as per DataLabs report, $6.97 billion was raised across 453 deals by Indian FinTech startups (2014-2018). Currently, there are a app. 2,707 Fintech Startups in India. In 2019 itself, an estimated $2.36 billion was pumped into Indian FinTech startups. According to DataLabs estimates, Karnataka (87), Maharashtra (87) and Delhi NCR (66) have the highest concentration of funded FinTech startups in India. The concentration of FinTech startups seems to be skewed towards the Indian metros. One of the possible reasons lies in requirement of large amount of capital and a highly skilled workforce which are easily available in tier 1 cities such as Bengaluru, Mumbai and Delhi NCR, compared to tier 2 locations.

FinTech: Addressing The Unbanked Indian?

Fintech's ability to merge cutting edge digital technology with state of the art data sciences has made it the darling of investment community. While FinTech as a sector is agnostic to consumer segments, it cannot be missed that the biggest potential for it lies in reaching out to unbanked. Globally, ~70% of adults (3.8 bn.) now have an account at a bank or mobile money provider as per World Bank. Interestingly, about 1.2 bn. of these accounts have been added since 2011. Also, a significant increase has been witnessed in the use of mobile phones and the internet to conduct financial transactions. Between 2014-17, this has contributed to a rise in the share of account owners sending or receiving payments digitally from 67% to 76% globally, and in the developing world from 57% to 70%.

In India alone around 19 crore adults are without a bank account despite the success of the ambitious Jan Dhan Yojana, making it the world’s second largest unbanked population after that of China, as per the World Bank report. Besides, almost half of the bank accounts remained inactive in the past year. The report also said that 11% of the world’s unbanked adults are in India. Given this huge opportunity and ability of FinTech to redesign the mechanism of new financial services delivery as well as redefine the experiences to end customers the scope is huge. And such solutions have been succeeding in both emerging and developing economies, creating solutions specifically for underserved, low-income, or remote customers.

To understand how specific FinTech innovations solve pain points in financial inclusion, in 2016, CGAP supported pilots with 18 Fintech in Africa and South Asia that targeted financial services to low-income or undeserved customers. Through their case studies they identified five types of FinTech innovation that offer potential for financial inclusion. The results of their findings are as follows:

1. Interactive customer engagement:

Historically, financial literacy programs for the undeserved have delivered mixed results, yet technology has the potential to deliver customized information and knowledge that is cheaper, scalable, and effective. However, technology itself is not enough; efforts need to focus on understanding the undeserved community’s need for information. It is also crucial to have robust mechanisms to measure the effects on engagement with financial services. Contracts between the learning platform vendor and the Financial Service Provider (FSP) need to include an adequate degree of data sharing, which improves the platform’s ability to produce useful insights. There needs to be a balance between technology and “human” (high-touch) interaction in a cost-effective way. At the same time being customer-centric and maintaining a long-term vision is crucial to success.

A. FinTech's ability to generate robust analytics on engagement through its platform leading to increase in use of the financial services was integral to understand its value proposition to the customer and to the FSP.

B. Different communications strategies with each FSP may be required as lessons are context-specific, and not one-size-fits-all. Spending the time to test and learn what works for each audience and tailoring the relationship can make a significant difference.

C. Sharing social proof (hypothetical stories based on real use cases); Gradually increasing messaging; Providing customer centered information (secret tips) as a part of the conversation, as opposed to general instructive information and Initiating question-and-answer conversations increase the engagement levels

D. Offering choices (languages, topics of conversation etc.); Shaping the conversation and Feeling heard increased the customer engagement levels and also led to specific, actionable product feedback.

E. Allow new users to explore and test the service before they register for full use. Images, text and specially video can be very useful to explain how the service can be useful. Even on the investor side, from established players to early-stage companies, all are using blog posts, social media messages and innovative educational videos to explain the opportunity and help them make informed decisions.

2. Smartphone-based payments:

The spread of smart phones and mobile-phone use has spurred the need to create innovative applications that leverage intuitive user interfaces and user experiences (UI/UX) to reduce dormancy in payments and encourage greater use. These applications are for the mass market, undeserved customer. They are often designed to use less data and storage and to appeal to younger, tech-savvy, yet largely undeserved, populations in emerging markets.

A. Availability of a large acceptance network that can respond to requests for cash. This is not easy to build from scratch, and sometimes it may require to rely on an existing agent network to facilitate early transactions. Regulation issues and necessary license to provide services is another area to look at.

B. Providing in-app guidance and access to agents’ addresses and phone numbers so that users can find the most convenient or most reliable agent. Having an easy and simple initial application sign-up is crucial to speed customer acquisition. Allow users to navigate directly to what they want and focus on taking actions or doing (not plain navigation) within menus. Prefer quick visual cues over text but test it first on local users to avoid confusion. Using designs that are familiar to users and plain language which is already in use is another element to focus on.

C. Use consumer usage data to derive popular actions and customize the interface and choices as per their unique usage. Features such as auto fill or easily repeat past transactions are useful. Provide a simple feedback mechanism and clear pathways to resolve problems. Customized, simple keyboards; a fee calculator alongside transactions; a consolidated summary transaction information on one screen; making finding the account balance easy; easiness to hide the balance on the screen are helpful

D. The ability to send money by selecting a contact from the phone book, a ready list of various utility accounts (electricity, etc.) on the app’s interface; the ability to have several wallets for several SIMs; the ability to use the app offline was particularly relevant for users in remote areas that have poor connectivity and for users who bought data from one provider using a wallet from another.

3. Connections-based finance:

Digital technologies are being used to help customers connect to social, entrepreneurial, and community networks to gain access to small amounts of credit when cash-flow gaps arise in business and life. These services build customers’ creditworthiness and access to finance through existing or new connections. The small amounts keep the risk low and the timeliness of credit helps customers better plan for cash-flow gaps and emergencies.

A. Until a FinTech builds a larger group of customers, its success hinges on its partnerships with other FSPs, especially its credit partners, and their partners’ willingness to lend to their customers. A FinTech cannot control the user interface of its mobile partner and faces high API integration charges, which it cannot incur at this point. However, in absence of a better alternative, customers might be willing to overcome inadequacies of the mobile payment interface to access timely cash-flow relief.

B. The lower-income segment typically requires an element of human interaction. The last mile bridge not only helps people understand the product, it also overcomes trust barriers. The factor to watch out here is the need to balance the operation costs for these measures with a scalable business model. If a large base of customers successfully repays and comes back for more loans, these costs could be reduced.

C. Technology can be used to strengthen traditional financial relationships by reducing friction and providing visibility. It can also be used to help people expand and maintain their networks (rural-urban). The platform should be made more effective by right messaging strategy. For example, A heading that reads “Give today, receive tomorrow” could inspire reciprocity-driven contributions. A message like “Giving now increases your chance of succeeding with a future fundraising campaign” could be used to encourage trust-driven giving. Also, fostering a sense of community on a fundraising platform is likely to increase use.

D. There was no evidence that peer-to-peer framing increases loan repayment. There was some evidence that this framing could increase retention, thus increasing the chances of the borrower taking a second loan with the same lender. Customers who received an SMS message and a call (with right messaging) were more likely to take a second loan.

E. Success of services which are based on two-sided or multi-sided networks, hinges on growing each side robustly and ensuring adequate connections. Building strong credit scores for each supplier, improving information on each supply chain, and then expanding the lender group that agrees to assess risk based on the credit score and lend. Testing across different pricing models for each supply chain and each lender group may be useful. FinTech will need to keep its focus and expand strategically.

4. Location-based smallholder finance:

Use of digital technologies and alternative data sources to reduce cost and expand access to financial services, such as credit and insurance, and to other valuable extension services for (say smallholder farmers) customers.

A. Merging different location data; Building a image based scoring model to an overall credit-scoring model that contains other factors and variables; using a relevant loan performance sample to achieve a high degree of predictability - supported by an initial model using location-based data needs to be iterated and tested through several cycles of loans and repayment for success

B. A cost-effective way to gather information is critical to scaling and expanding access. Remote assessment models can be cost effective solution to gather data (farmer location) and are both effective and scalable. Input distribution and fulfillment via local dealers can be another cost effective and logistically simple to manage than direct delivery. Effectiveness of communication is crucial when introducing more complex financial products (bundled products)

C. Innovative satellite data applications has huge potential to improve efficiency and effectiveness within smallholder insurance markets. Also, it is critical for insurers to partner with public (especially) and private actors to facilitate access to accurate yield data, past and present, which are needed to complement satellite data. Larger yield data sets that cover larger geographical areas and longer periods of time may eliminate the need for yield sampling.

5. De-risking unproductive expenses:

Helping low-income people pay for unexpected or big expenses through de-risked credit, while using unique features to reduce risk for the financier.

A. The most significant remains the time required for the FSP to conduct a loan assessment and the cumbersome data-sharing process between FinTech and the FSP. The agreement between the two must include complete system integration through an API; mandatory training of FSP staff, including those in branches, before launch; complete visibility into incentives for branch staff and loan officers and clearly defined project governance structures. With a group like farmers making the technology work remains a major challenge. Also, lack of connectivity adds to the complexity.

B. Customers indicated that the feature they valued most was duration of insurance coverage. The other factors—amount of coverage and number of family members covered—were also important. And a combination of all three increased people’s willingness to pay. This suggests that the preferred solution should cover family members and offer a reasonable coverage amount, but that extending the duration of coverage should be emphasized.

Attached Images